How SARS can 'pierce' the corporate veil to catch tax avoiders

News24

12 Jul 2019, 11:43 GMT+10

A relatively unknown piece of legislation could be an ace up the sleeve of the South African Revenue Service as it tries to catch shareholders who hide behind a company to avoid paying their taxes, according to a new study conducted at Stellenbosch University.

The study was done by Dr Albertus Marais as part of his doctoral thesis in Mercantile Law.

Piercing the corporate veil doesn't mean that the company's existence is being cancelled, but rather that its existence is ignored for a specific enquiry only, for instance the determination of tax consequences.

10 tax trends SARS is clamping down on

Marais notes that shareholders may use the corporate veil to avoid taxes by transferring shares held by an individual or a trust to a company of which the individual or trust is a shareholder.

In this way, dividend tax of the underlying share portfolio is avoided, since South African companies, as shareholders, are typically exempt from dividend tax on dividends declared to them.

"For income tax purposes in particular it may be beneficial for individuals to involve companies or layered company structures in transactions due to the beneficial regimes that the Income Tax Act affords companies," says Marais.

Creating awareness

He adds that it is important to create awareness about the potential application of Section 20(9), because the Income Tax Act's broad and powerful general anti-avoidance rules do little to address this problem.

"Tax avoidance is a distinctly grey area and the line between permissible and impermissible avoidance is far from clear," says Marais.

"Hopefully this study will contribute to making that distinction slightly clearer, especially where tax planning through the use of companies is involved."

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Cape Town Express news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Cape Town Express.

More InformationInternational

SectionUS sends message by publicizing visa ban on UK punk-rap band

WASHINGTON, D.C.: The Trump administration has made public a visa decision that would usually be kept private. It did this to send...

Tragedy in Spain: Diogo Jota and his brother die in car accident

MADRID, Spain: Liverpool footballer Diogo Jota and his younger brother, André Silva, have died in a car accident in Spain. Spanish...

Early heatwave grips Europe, leaving 8 dead and nations on alert

LONDON, U.K.: An unrelenting heatwave sweeping across Europe has pushed early summer temperatures to historic highs, triggering deadly...

U.S. military, China, Russia in Space race

President Donald Trump's plans to build a space-based Golden Dome missile defense shield have drawn immediate criticism from China,...

Trump wins $16 million settlement from Paramount over CBS Harris edit

NEW YORK CITY, New York: Paramount has agreed to pay US$16 million to settle a lawsuit brought by U.S. President Donald Trump over...

British PM faces major party revolt over welfare reforms

LONDON, U.K.: British Prime Minister Keir Starmer won a vote in Parliament this week to move ahead with changes to the country's welfare...

South Africa

SectionUAE highlights potential of deeper trade, investment collaboration between BRICS nations

Rio de Janeiro [Brazil] July 6 (ANI/WAM): The United Arab Emirates, represented by Thani bin Ahmed Al Zeyoudi, Minister of Foreign...

KL Rahul becomes second Indian after Gavaskar to achieve unique SENA feat

Birmingham [UK], July 5 (ANI): KL Rahul continued his fine overseas run in Test cricket, becoming only the second Indian opener after...

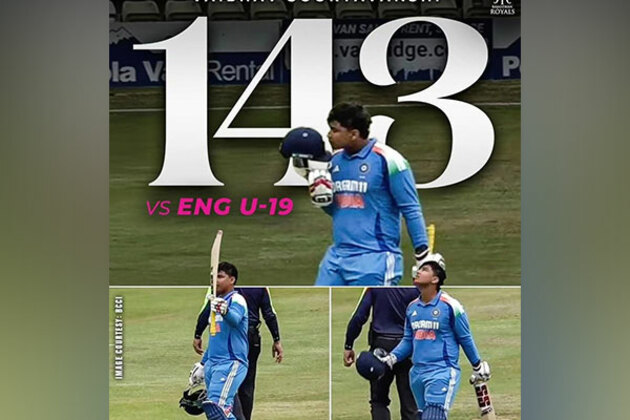

Vaibhav Suryavanshi smashes fastest U19 ODI century, becomes youngest centurion in this age group

Worcester [UK], July 5 (ANI): India's 14-year-old batting sensation Vaibhav Suryavanshi cracked the fastest century in the U19 ODI...

Sanju Samson returns to Kerala Cricket with record-breaking KCL signing

Thiruvananthapuram (Kerala) [India], July 5 (ANI): Indian wicketkeeper-batter Sanju Samson made a record-breaking return to the Kerala...

Xinhua Headlines: BRICS strengthens momentum, stability in Global South cooperation

* In recent years, BRICS has transformed into a major force fostering cooperation among Global South nations. This collaboration not...

West Bengal: Court award life imprisonment to rape accused in post-poll violence rape case

Malda (West Bengal) [India] July 4 (ANI): The Additional District and Sessions Judge of the 2nd POCSO Court in Malda, West Bengal,...